Your Guide to the Best Homeowners Insurance in New York

Owning a home in the Empire State—whether it's a historic brownstone in Brooklyn, a cozy colonial in Buffalo, or a high-rise condo in Manhattan—is a significant achievement. But protecting that dream against coastal storms, harsh winter freezes, and the unique risks of city living is a complex reality.

Navigating the New York homeowners insurance landscape can feel overwhelming. Finding the right policy isn't just about picking a name from a list; it's about understanding real-world costs, comparing nuanced policies, and knowing what your specific type of home truly needs.

This guide cuts through the noise. We have analyzed data from the New York State Department of Financial Services, independent rating agencies, and top insurance providers to bring you a definitive guide to 2025 costs, top-rated companies, and the specific needs of New York homeowners. We will also show you a proven way to lower your annual premium.

The Bottom Line: Best NY Homeowners Insurance for 2025 at a Glance

For those who want the quickest answer, the "best" homeowners insurance company ultimately depends on your individual priorities—whether you value the lowest possible price, the highest level of customer service, or specialized coverage for a high-value property. The table below summarizes our top picks across key categories based on a comprehensive analysis of cost, ratings, and service data.

| Company | Average Annual Rate ($350k Dwelling) | J.D. Power Score (Overall Satisfaction) | NAIC Complaint Index | Best For |

|---|---|---|---|---|

| NYCM Insurance | $520 | Not Rated | 0.63 (Good) | Lowest Premiums |

| State Farm | $1,226 | 643 (Good) | 1.85 (Poor) | Customer Satisfaction |

| Chubb | $1,701 | #1 Ranked | Not Rated | High-Value Homes |

| Allstate | $1,860 | 631 (Poor) | Not Rated | Short-Term Rentals |

| Travelers | $964 | Not Rated | Not Rated | Newly Insured Homes |

Here are the top 10 best homeowners insurance companies in NYC, based on comprehensive coverage options, affordability, and customer satisfaction:

State Farm: State Farm is renowned for its excellent customer service and comprehensive coverage options, including dwelling coverage, personal property, and liability.

Allstate: Allstate offers robust home insurance policies with a variety of add-ons, such as flood insurance and water backup coverage.

Liberty Mutual: Liberty Mutual provides a wide range of coverage options, including dwelling coverage and medical payments.

Chubb: Chubb is known for its high-value home insurance policies, ideal for high-net-

USAA: USAA offers competitive rates and comprehensive coverage exclusively for military members and their families.

Nationwide: Nationwide provides customizable home insurance policies with options for flood insurance and identity theft coverage.

Travelers: Travelers offer a wide range of policy options, including coverage for older homes and eco-friendly home upgrades.

American Family Insurance: American Family Insurance is praised for its customer service and wide range.

AIG: AIG specializes in high-value homes and provides extensive dwelling coverage.

Farmers Insurance: Farmers Insurance offers a range of policies with options for additional coverage like flood insurance and personal property.

NYCM (New York Central Mutual) : NYCM Insurance is a regional insurance provider that offers personalized service and a variety of home insurance policies tailored to New Yorkers. With a strong focus on customer satisfaction and competitive pricing, NYCM is a solid choice for homeowners in NYC.

How Much Does Homeowners Insurance Cost in New York in 2025?

This is the first question on every homeowner's mind. The average cost of homeowners insurance in New York ranges from approximately $1,229 to $1,740 per year. However, your personal premium will vary significantly based on where you live, your home's value, and other specific risk factors. The key takeaway is that New York's average rates are generally lower than the national average, which ranges from $2,110 to $2,614 per year.

Of course, your personal premium will vary significantly based on where you live and other specific risk factors.

Average Home Insurance Costs in Major New York Cities

Location is one of the biggest drivers of cost. Premiums reflect local factors like weather risk, construction costs, and crime rates. As the data shows, rates in and around New York City are considerably higher than in upstate metropolitan areas.

| City | Average Annual Cost | Average Monthly Cost |

|---|---|---|

| New York City | $1,782 | $149 |

| Hempstead | $1,427 | $119 |

| Yonkers | $1,334 | $111 |

| Albany | $1,056 | $88 |

| Buffalo | $1,108 | $92 |

| Syracuse | $1,028 | $86 |

| Rochester | $973 | $81 |

Source: MoneyGeek 2023 premium dataHow Your Coverage Amount Impacts Your Premium

The amount of dwelling coverage you need—the limit to rebuild your home's structure—is the foundation of your policy's cost. The more it would cost to rebuild your home, the higher your premium will be.

A policy with $100,000 in dwelling coverage averages $640 per year.

A policy with $250,000 in dwelling coverage averages $1,229 per year.

A policy with $500,000 in dwelling coverage averages $2,354 per year.

This data helps you benchmark your potential costs based on your home's value.

Other Key Factors That Determine Your NY Insurance Rate

Beyond location and home value, insurers assess several personal factors to calculate your premium. It is important to understand that these factors often have a compounding effect; having an older home and a poor credit score will result in a much larger premium increase than either factor would alone.

Your Credit Score: This has a dramatic impact on your rates in New York. Homeowners with poor credit pay an average annual premium of $2,421, which is nearly double the state average of $1,229 for those with good credit. For those with poor credit, companies like Chubb are often a suitable option.

Your Claims History: A history of filing claims signals higher risk to insurers. In New York, a homeowner with a clean record pays an average of $1,229 annually. After just one claim in the past five years, that average jumps to $1,437.

The Age of Your Home: Older homes, with their potentially outdated plumbing, electrical, and structural systems, often cost more to insure. For New York's many historic homes, providers like NYCM and State Farm are often cited as having competitive rates. The average premium for a newly constructed home in New York is just $812

What a Standard Policy Covers (And What It Doesn't)

A standard HO-3 policy is a package of several distinct coverages :

Coverage A - Dwelling: Protects the physical structure of your house.

Coverage B - Other Structures: Covers detached structures like a garage or shed.

Coverage C - Personal Property: Covers your belongings, like furniture and electronics.

Coverage D - Loss of Use: Pays for additional living expenses if your home is uninhabitable after a covered loss.

Coverage E - Personal Liability: Protects you financially if you are sued for injuring someone or damaging their property.

Coverage F - Medical Payments to Others: Covers minor medical bills for a guest injured on your property, regardless of fault.

Crucial Exclusions: It is vital to know that standard homeowners policies in New York DO NOT cover damage from floods (including storm surge from hurricanes), earthquakes, or sewer/drain backups. These require separate policies or specific endorsements (add-ons) to your policy.

Replacement Cost vs. Actual Cash Value: A Critical Choice

When insuring your home and belongings, you will face a choice between two valuation methods:

Replacement Cost (RC): This covers the cost to repair or replace your damaged property with new items of similar kind and quality, without deducting for depreciation.

Actual Cash Value (ACV): This reimburses you for the replacement cost minus depreciation. For example, it would pay for a 10-year-old roof, not a brand-new one.

For comprehensive protection that allows you to fully rebuild and refurnish your home after a major disaster, Replacement Cost coverage is almost always the recommended choice.

Why NYC Homeowners Need Homeowners Insurance

Imagine this: a fire damages your newly renovated kitchen, or a burst pipe floods your basement. Without homeowners insurance, you could face significant financial losses.

Here's why homeowners insurance is a must in New York:

Financial Protection: Covers repairs, replacement of belongings, and liability costs.

Peace of Mind: Knowing you're protected allows you to focus on recovery, not financial burdens.

Mortgage Requirement: Most lenders require homeowners insurance to protect their investment.

Partner with Kangaroo for Home Insurance Discounts

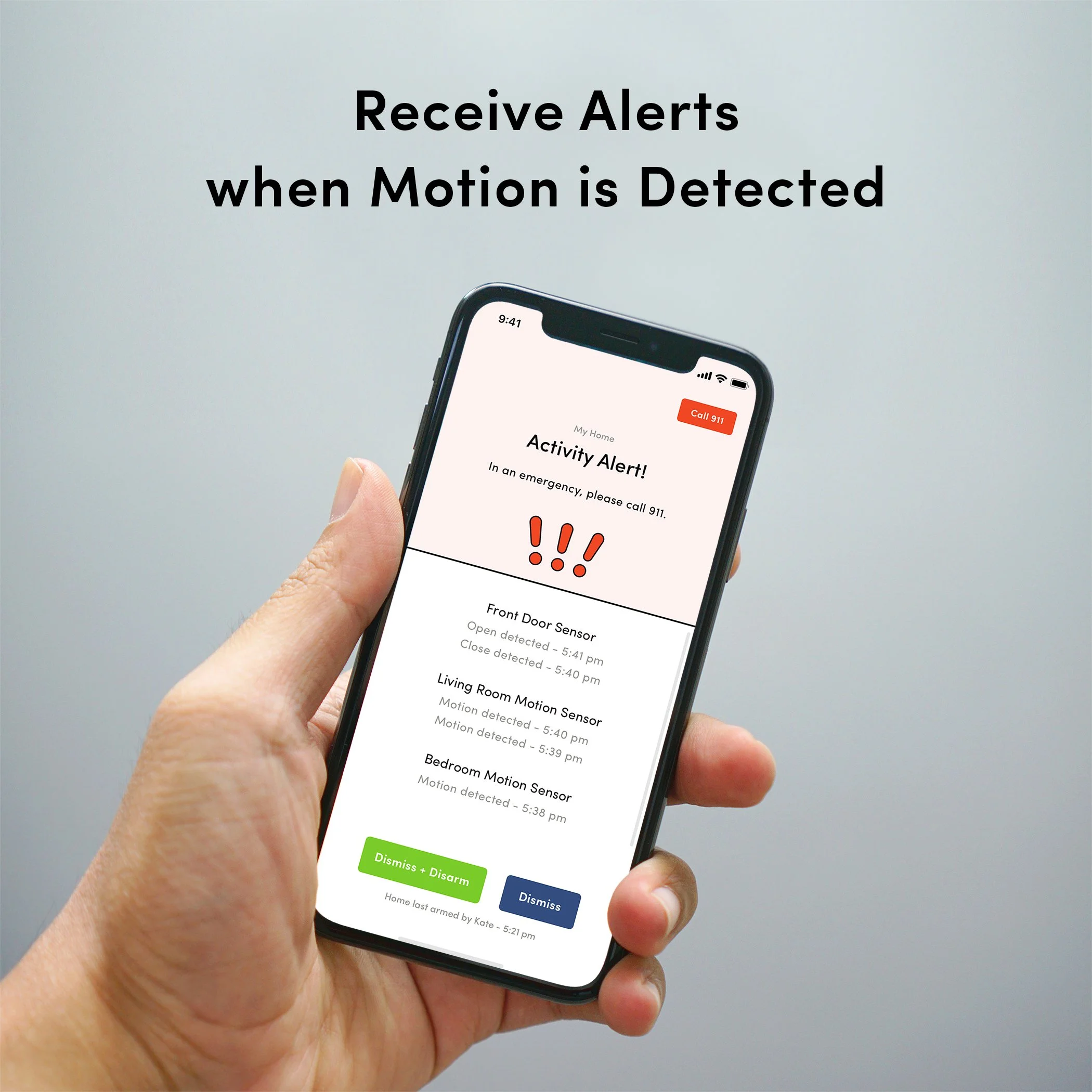

Did you know that having a home security system can often lead to discounts on your homeowners insurance?

Kangaroo Home Security offers affordable and easy-to-install security solutions that can help you save. Many insurance companies offer discounts for homes with security systems, as they reduce the risk of burglary and property damage.

Here's how Kangaroo can help:

Affordable Security: Kangaroo's systems are budget-friendly, making home security accessible to everyone.

Easy Installation: DIY installation means no need for costly professional installers.

Insurance Discounts: Potentially save hundreds on your premiums by integrating Kangaroo's security products.

Dory Insurance Concierge: Kangaroo can connect you with insurance providers offering discounts for qualifying security systems.

General Tips to Save on Your Home Insurance Premiums

Beyond installing a security system, here are more ways to lower your homeowners insurance costs:

Bundle Policies: Combine home and auto insurance for discounts.

Increase Deductible: Opt for a higher deductible to lower your monthly premiums.

Maintain Good Credit: A good credit score can lead to lower insurance rates.

Claims-Free Discount: Inquire about discounts for a history of no claims.

Shop Around: Compare quotes from multiple insurers to find the best rates.

Ask About Discounts: Inquire about discounts for new homeowners, paying annually, or group affiliations.

By implementing these strategies, you can find the best homeowners insurance in New York that offers both comprehensive coverage and affordability.

Q&A: Navigating Homeowners Insurance in New York

-

Homeowners insurance protects your property and belongings from various risks, including fire, theft, and natural disasters. It provides financial coverage and peace of mind.

-

Compare quotes, bundle policies, maintain good credit, install safety features, and ask about available discounts.

-

Location, age and condition of your home, coverage limits, claims history, and safety features all influence your insurance costs.

-

It protects your belongings (furniture, electronics, etc.) from theft or dam

-

Item descComparing allows you to evaluate coverage levels, premiums, and discounts to find the best policy for your needs.

-

It's the amount to replace or repair your home or belongings with similar materials at current prices, without deducting for depreciation.

-

Increase your deductible, bundle policies, install safety devices, maintain good credit, and inquire about discounts.

Finding the right homeowners insurance in New York is essential for protecting your investment and ensuring peace of mind. By following this guide, you can make informed decisions and find the best coverage at an affordable price.

![[QUIZ] What's Your Home's True Security Vulnerability Score?](https://images.squarespace-cdn.com/content/v1/6047adb1f3383c71b64f494b/7b99bd74-f07d-42ae-a096-72ee222bde79/IMG_4306.jpg)

Think more cameras mean more safety? Discover 3 ways an over-secured home can attract burglars and learn why smart, discreet security is the better choice.